Explore Our Strategies

Castellan Targeted Equity

An actively managed, all-cap U.S. equity strategy seeking capital appreciation and alpha generation, utilizing multiple factors including strengthening earnings, proprietary calculations of momentum and relative strength, and a disciplined valuation framework.

Castellan Targeted Income

An actively-managed, large-cap U.S. equity strategy combining a portfolio of low-volatility stocks with a covered call strategy historically providing attractive monthly income, while offering the opportunity to participate in equity growth potential.

Castellan Income Growth

An actively-managed strategy investing in income-producing stocks across REITs, utilities, energy infrastructure companies and MLPs, aiming for high income and inflation protection.

Castellan Alpha VolParTM

An actively-managed allocating portfolio weights across asset classes so that each class contributes an equal amount of risk with the goal of smoother, more consistent returns seeking strong risk-adjusted performance through changing market conditions.

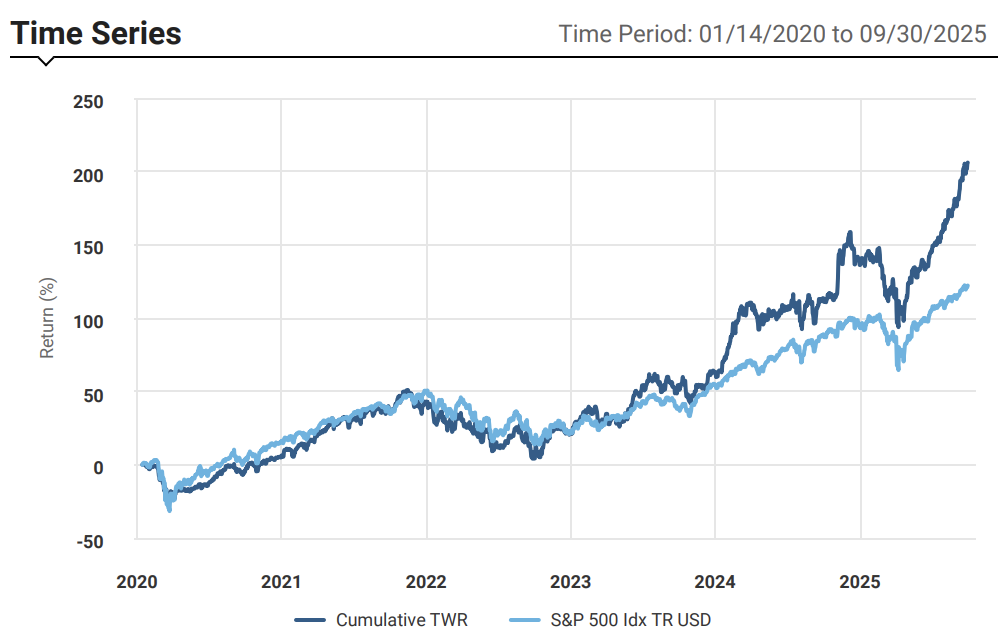

Targeted

Equity

- Targeted Equity is a stock-picking strategy that aims to find stocks with strong value and momentum characteristics.

- The candidate pool for TE is determined by several fundamental factors, including earnings growth and value characteristics.

- The strategy targets 20 stocks, and entries/exits are determined by either large movements in consensus earnings estimates or significant changes in momentum scores.

- Option strategies are often used to enhance upside returns for new purchases.

- TE aims to have long-term holdings for tax efficiency, although the average holding period is less than 1 year.

Time Period: 01/14/2020 to 09/30/2025

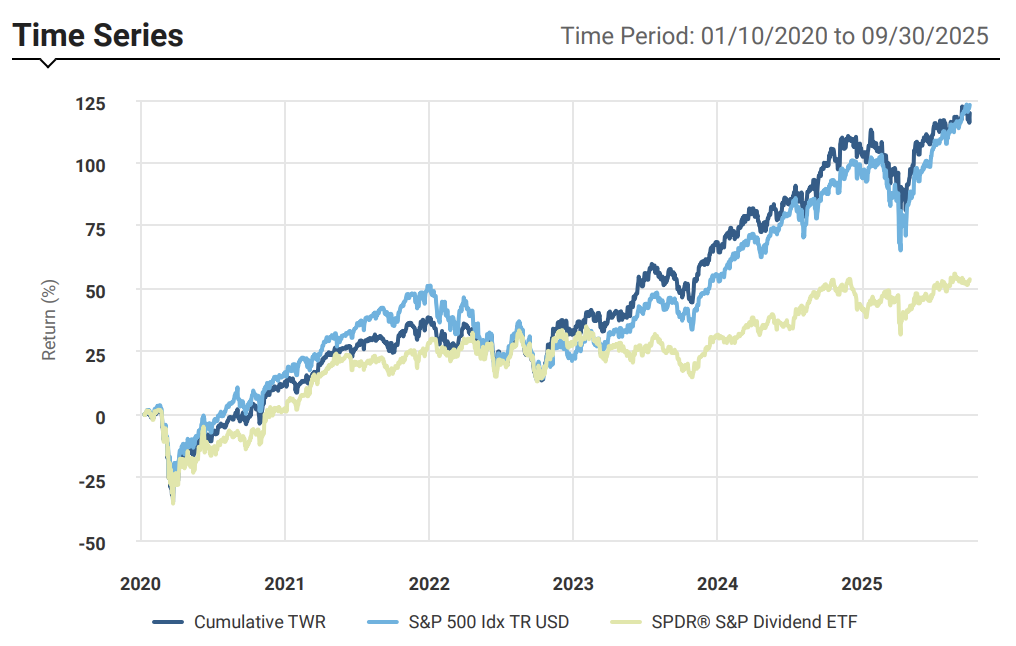

Targeted Income

- Targeted Income is a stock-picking strategy that only considers companies with a strong history of growing dividends.

- A multi-factor screen is utilized to determine candidates for the portfolio, which typically holds around 20-22 holdings.

- Balance sheet strength, earnings growth, dividend growth, and payout ratio are among the metrics applied.

- Additional income is manufactured on top of dividends through selling short-term covered calls on a portion of the holdings.

- This call selling attempts to take advantage of the fast decay from short-term out-of-the-money options.

Time Period: 01/10/2020 to 09/30/2025

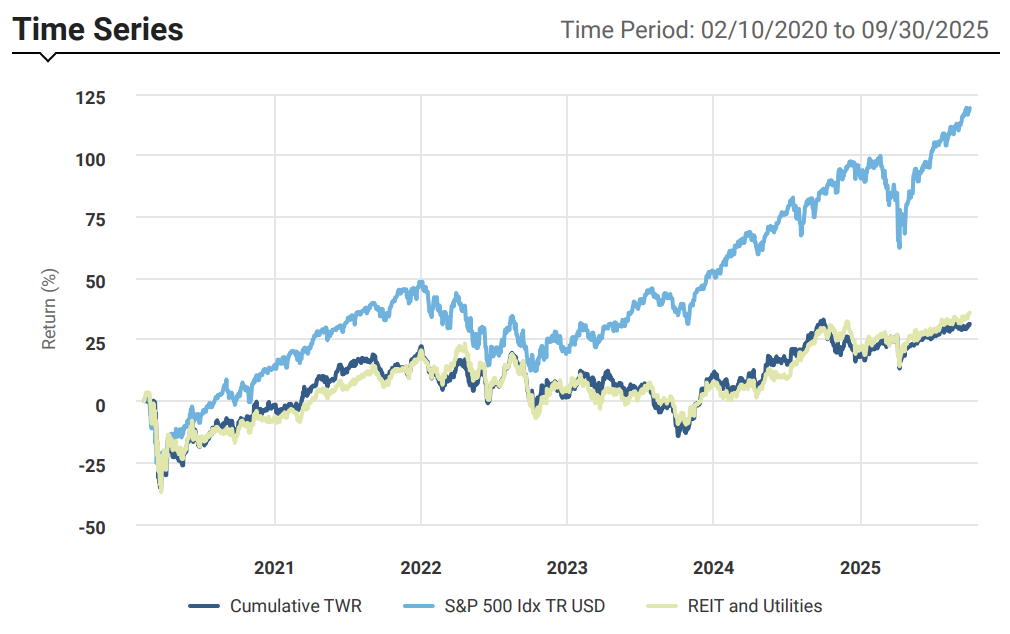

Income Growth

- Income Growth holds a portfolio of 14-15 REITs, utilities, and MLPs emphasizing high dividend rates and growth of dividends.

- All holdings are ranked on current income + expected future income.

- Candidates are screened for quality and undergo an elimination rules checklist to find the highest-rated candidates.

- Income Growth is rebalanced quarterly with low turnover.

Time Period: 02/10/2020 to 09/30/2025

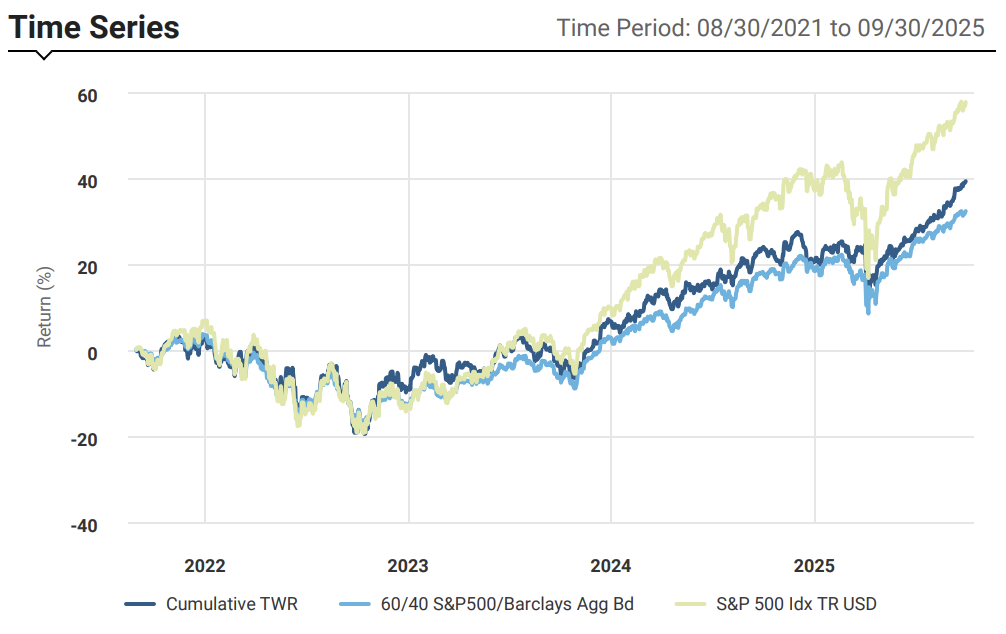

Alpha

VolPar Composite

- VolPar is a risk-parity based asset allocation strategy that contains four asset classes: Real Estate, Fixed Income, Commodities, and Equities.

- This strategy leverages our existing equity strategies and adds uncorrelated exposure, designed to deliver performance regardless of macroeconomic conditions

- Asset allocations are determined by macroeconomic research that classifies the current market conditions into a regime, directly informing our allocations.

- Leverage is utilized to drive up annual expected returns, much like traditional risk parity.

Time Period: 08/30/2021 to 09/30/2025